Private property market in Singapore can be tricky indeed. In our previous two posts, Part 1 and Part 2 of this series, we discussed possible factors that may cause private property prices in 2019 to stall. Today, we will discuss bullish factors for Singapore private property prices in 2019.

Singapore is one of the nicest places to live in

We all know that Singapore is one of the nicest countries to live in the world. Many foreigners come to our country and buy our properties because they recognise the value of our country’s security, stability and prosperity. However, it is our opinion that immigration trends would not be the biggest influence on prices in 2019.

Developers’ Land Cost is a big factor

Instead, one of the most influential factors on prices would be the developers in Singapore. Developers in Singapore acquire land either from the government through government land sale (GLS) or from collective sales (en bloc). Subsequently, after building on the land, developers will then sell it to property buyers like you and I at a profit. As such, the price at which developers obtain their land bank would be a huge factor in determining the eventual private property price sold to the average buyer. This is because land cost is the developers’ single largest cost in their business.

Record-breaking land sales in 2017 to 2018

In year 2014 to 2016, there were a total of 33 land sales, comprising 29 government land sales and 4 en blocs. However, in 2017, a frenzy for enbloc sale across the country started. In just this one year alone, developers snapped up land in 37 land sales which was valued at $8.65 billion. That is more than the previous 3 years combined. Moreover, in the first half of 2018, the craze continued and 43 land sales totalling $10.1 billion worth of land was added to developers’ bank. The combined value of these one and a half year is almost double of the record setting year of 2007, where 111 land sales valued at $11.3 billion was acquired by developers.

Record-breaking Land Costs = Record-breaking Property Prices?

That is a lot of numbers, but the implication is this.

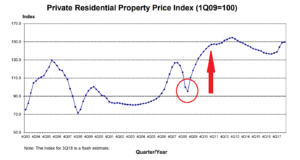

Property prices rebounded sharply and quickly in 2008 because the rush of en bloc money flooded the property market.

Notice that in 2007, despite the recession caused by the subprime crisis, property prices rebounded sharply and quickly. This was because the rush of en bloc money flooded the property market with cash rich buyers that needed new places to stay after their homes were collectively bought out. We are seeing a similar circumstance today. The combined $19 billion purchased at record-breaking cost to developers will definitely have an impact on prices in the years to come, even if it is beyond 2019.

In summary, with all the factors presented to you so far, it is up to you to eventually decide which factors will play the most important role in determining prices, be it up or down. We find that the best way to add value as property agents is to provide our carefully-researched perspective and then advise you accordingly, so we hope that you have benefited from this series. If you like our approach and would like to benefit from our quantitative analysis as well, feel free to contact us and we will do our best to provide our best service. That’s it for today, this is Isaac, keeping property real for you.

If you enjoy this post, please subscribe to our Youtube channel and click on the bell icon to keep notified of our new content! You can also comment below to let us know what topic you want us to cover!